Hello all - we hope you had a nice September.

While we hope you had a nice September, it wasn’t a nice month for the markets. In fact, it was the worst month in over two years. Stocks actually started out on a strong note, but a higher-than-expected inflation report pricked the bubble and the market fell sharply for the rest of the month.

The Dow fell 8.8%, the S&P 500 lost 9.3%, and the Nasdaq, which has a higher concentration of tech companies, closed down by 10.5%.

We also closed out a dismal third quarter, for three negative quarters in a row. That hasn’t happened since 2009. For the quarter, the Dow was off 6.7%, the S&P was off 5.3%. and the Nasdaq dropped 4.1%.

While we hope you had a nice September, it wasn’t a nice month for the markets. In fact, it was the worst month in over two years. Stocks actually started out on a strong note, but a higher-than-expected inflation report pricked the bubble and the market fell sharply for the rest of the month.

The Dow fell 8.8%, the S&P 500 lost 9.3%, and the Nasdaq, which has a higher concentration of tech companies, closed down by 10.5%.

We also closed out a dismal third quarter, for three negative quarters in a row. That hasn’t happened since 2009. For the quarter, the Dow was off 6.7%, the S&P was off 5.3%. and the Nasdaq dropped 4.1%.

Here’s a closer look at the markets this month.

Every sector was lower, which is uncommon.

Market volatility started rising in August and continued to rise sharply in September.

It wasn’t just stocks, but bonds have fared very poorly. Bond yields are reaching their highest levels in over a decade, which means the bond prices have fallen by a similar amount.

Investment portfolios typically have two main asset classes: stocks and bonds. Bonds are seen as safer than stocks, and riskier portfolios have less bonds and more stocks.

An average diversified portfolio might have around 60% stocks and 40% bonds. Since bonds have done so poorly this year, that 60/40 portfolio has had its worst year since 1931.

An average diversified portfolio might have around 60% stocks and 40% bonds. Since bonds have done so poorly this year, that 60/40 portfolio has had its worst year since 1931.

This shows how unusual the drop in bonds has been this year.

____

THE FED

This market behavior is still all due to the Fed.

For several months now, the Fed has expressed their worry over high inflation. Their cure for high inflation is to slow down the economy by raising borrowing costs (interest rates). This month they raised interest rates by another 0.75%.

The pace at which they are raising interest rates is the fastest on record.

We think the Fed is making a mistake here.

The Fed has undertaken the biggest stimulus program in the history of the world (it’s true), and they do need to pull back from that stimulus. And we knew getting out of the stimulus would be a problem. But the argument the Fed is using to justify its rate increases is just flat out wrong.

The Fed believes inflation and employment are related – they think inflation is caused when employment is good (more are people working and spending money) and vice-versa.

Therefore, their solution to bringing inflation down is to reduce employment (less people working, so more people fired). This is their justification for slowing down the economy.

However, it is not true that more employment results in more inflation, especially at this time.

The current inflation is actually caused by a couple factors, like high energy prices, problems with the supply chain coming out of Covid shutdowns, and by too few people working.

Coming out of Covid, businesses were pleading for more workers and had to pay higher wages to entice workers back. Wages have remained high ever since and have even continued climbing. Businesses have raised their prices as a result of paying higher wages. Its this lack of employment that has caused inflation.

The real solution to inflation is to boost employment, not reduce it. This is the exact opposite of what the Fed believes.

The Fed has undertaken the biggest stimulus program in the history of the world (it’s true), and they do need to pull back from that stimulus. And we knew getting out of the stimulus would be a problem. But the argument the Fed is using to justify its rate increases is just flat out wrong.

The Fed believes inflation and employment are related – they think inflation is caused when employment is good (more are people working and spending money) and vice-versa.

Therefore, their solution to bringing inflation down is to reduce employment (less people working, so more people fired). This is their justification for slowing down the economy.

However, it is not true that more employment results in more inflation, especially at this time.

The current inflation is actually caused by a couple factors, like high energy prices, problems with the supply chain coming out of Covid shutdowns, and by too few people working.

Coming out of Covid, businesses were pleading for more workers and had to pay higher wages to entice workers back. Wages have remained high ever since and have even continued climbing. Businesses have raised their prices as a result of paying higher wages. Its this lack of employment that has caused inflation.

The real solution to inflation is to boost employment, not reduce it. This is the exact opposite of what the Fed believes.

____

INFLATION

With the Fed so focused on inflation, investors have been paying very close attention to it, too.

Investors were looking for inflation to come down over the past month, but the CPI report showed inflation increasing again when looking at it month-by-month.

On a yearly basis the inflation level is lower, but still higher than investors were expecting.

The higher inflation report sparked a strong market sell-off that continued until the end of the month.

On a positive note, inflation at the business level (the PPI) had its second month lower. This was driven largely by the lower gas prices.

We’re seeing evidence of more costs coming down, too, and this will translate into lower CPI and PPI prints in the future.

____

OTHER ECONOMIC DATA

We’ll start with a positive report. Economists forecast for GDP this quarter are rising as economic data hasn’t been too bad.

Over the past month, the strength of the manufacturing and service sectors were both roughly flat.

Retail sales were up slightly.

Durable goods - which are items with a longer life, like a phone or dishwasher – were also up slightly.

Sentiment continues to improve. Consumer confidence moved higher for the second month.

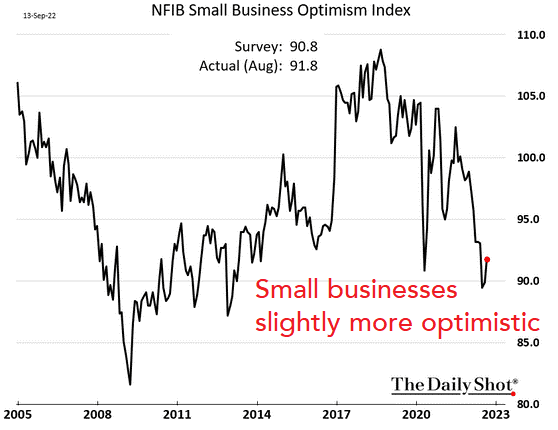

Confidence at small businesses had been very poor, but saw its second higher month.

____

Where does the market go from here?

Last month we stated the markets looked cheap in the short run and were likely to rise – and markets did rise. Only to later sell-off strongly.

Based on the indicators we watch, stocks again look very oversold (cheap) in the short-term. At the end of the month, only 3% of stocks in the S&P 500 were above their average of the last 50 days. Only 12% of stocks are above their 200-day average. These are numbers usually seen at market lows.

We wouldn’t be surprised to see a rise in stocks from here, but inflation and employment reports will be very important in determining market direction.

Another thing the market has going for it is seasonality. October has historically been the best month during midterm election years. This year has been anything but normal, so we wouldn’t rely on this too much!

Another thing the market has going for it is seasonality. October has historically been the best month during midterm election years. This year has been anything but normal, so we wouldn’t rely on this too much!

This commentary is for informational purposes and is not investment advice, an indicator of future performance, a solicitation, an offer to buy or sell, or a recommendation for any security. It should not be used as a primary basis for making investment decisions. Consider your own financial circumstances and goals carefully before investing. Past performance cannot guarantee results.