Hello all - we hope you had a nice August. Hard to believe we are already into September.

Markets started the month moving higher, but reversed course to finish the month in the red. The Dow fell 4.1%, the S&P 500 lost 4.2%, and the Nasdaq, which has a higher concentration of tech companies, closed down by 4.6%.

Markets started the month moving higher, but reversed course to finish the month in the red. The Dow fell 4.1%, the S&P 500 lost 4.2%, and the Nasdaq, which has a higher concentration of tech companies, closed down by 4.6%.

Here’s a closer look at the markets this month.

August also started with a low level of volatility in the market, but it quickly became volatile.

_____

THE FED

This month was all about the Fed.

Stocks rose early in the month when economic data showed inflation finally starting to turn lower and economic data weakening. The thinking for investors was that a weaker economy and lower inflation would make the Fed less likely to keep pulling back on its stimulus.

However, the Fed held a gathering in Jackson Hole, WY with central bankers from all over the world in attendance (isn’t it nice how these government employees get retreats all over the world?).

At this meeting, Fed chief Jerome Powell cited concerns about high inflation. He stated that even if the economy slows and inflation comes down slightly, they’ll keep pulling back on their stimulus. This is the opposite of what investors expected and stocks sold off as a result.

Here’s a quote that got a lot of attention:

That means the Fed will keep pulling back on stimulus, no matter what. Investors looking for a softer tone from the Fed have been sorely disappointed.

This month was all about the Fed.

Stocks rose early in the month when economic data showed inflation finally starting to turn lower and economic data weakening. The thinking for investors was that a weaker economy and lower inflation would make the Fed less likely to keep pulling back on its stimulus.

However, the Fed held a gathering in Jackson Hole, WY with central bankers from all over the world in attendance (isn’t it nice how these government employees get retreats all over the world?).

At this meeting, Fed chief Jerome Powell cited concerns about high inflation. He stated that even if the economy slows and inflation comes down slightly, they’ll keep pulling back on their stimulus. This is the opposite of what investors expected and stocks sold off as a result.

Here’s a quote that got a lot of attention:

While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

_____

Inflation did finally tick lower this month, which is why many investors were looking for the Fed to moderate their stance.

Inflation at the business level (the PPI) finally had its first lower month in over two years. This was driven largely by the lower gas prices.

_____

OTHER ECONOMIC DATA

Employment data has been a bright spot for the economy. Monthly job figures show solid gains.

Further, the level of job opening remains high, with two job openings available for every one unemployed person in the country.

Outside of employment, other economic data looks rather poor. Several parts of the country are seeing shrinking economies.

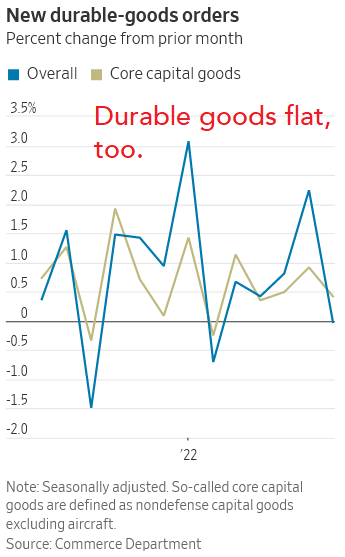

On the national level, manufacturing continued to move lower.

However, the service sector ticked up slightly.

Retail sales were flat on the month.

Sentiment finally improved last month. Consumer confidence moved higher.

Confidence at small businesses had been very poor, but finally saw a slight rise over the last month.

_____

Where does the market go from here?

Markets look a little oversold (cheap) in the short term. We’d like to see some strength before putting new money in (like higher days with solid volume, less stocks trading at their lows of the year, etc.), but we may be seeing a good opportunity soon. Of course, it all depends on comments from the Fed and new economic data results.

Keep in mind that the fall tends to be a very volatile time for the markets. There have been historic crashes in October, and September has been the worst month of the year for investors. Caution is warranted.

Markets look a little oversold (cheap) in the short term. We’d like to see some strength before putting new money in (like higher days with solid volume, less stocks trading at their lows of the year, etc.), but we may be seeing a good opportunity soon. Of course, it all depends on comments from the Fed and new economic data results.

Keep in mind that the fall tends to be a very volatile time for the markets. There have been historic crashes in October, and September has been the worst month of the year for investors. Caution is warranted.

This commentary is for informational purposes and is not investment advice, an indicator of future performance, a solicitation, an offer to buy or sell, or a recommendation for any security. It should not be used as a primary basis for making investment decisions. Consider your own financial circumstances and goals carefully before investing. Past performance cannot guarantee results.