Hello all - we hope you had a nice April.

After a steadily rising market since November, the markets finally broke lower this month. The Dow fell 5.0%, the S&P 500 lost 4.2%, and the Nasdaq, which has a higher concentration of tech stocks, was lower by 4.4%.

After a steadily rising market since November, the markets finally broke lower this month. The Dow fell 5.0%, the S&P 500 lost 4.2%, and the Nasdaq, which has a higher concentration of tech stocks, was lower by 4.4%.

Here’s a look at how the markets moved this month:

Here’s a look at how the various sectors performed:

As we mentioned earlier, the market has seen a steady rise since November of 2023, trading in a narrow, upward sloping range. Unfortunately, when trading in a narrow range like this, the trend is usually broken to the downside. That’s what we saw this month.

We’re also seeing the bigger stocks become bigger, and they are becoming more of the index. The top-10 biggest stocks in the S&P 500 now account for about 34% of the entire index. This is the highest concentration since the 1970’s.

This is a problem because concentrated markets are less stable and prone to bigger moves like we saw this month.

This is a problem because concentrated markets are less stable and prone to bigger moves like we saw this month.

____

APRIL DECLINE

What was the reason for the decline in the markets this month?

We believe most of the gain in recent months has been due to the Fed as they appeared less likely to lower interest rates.

Some analysts were expecting six to eight rate cuts this year. However, economic data has made this less likely. Economic growth has been positive, though slowing, and inflation has remained high. This is often referred to as ‘stagflation,’ and its one of the worst environments to be in.

Several Fed presidents made public comments this month that they see the possibility of just one rate cut this year – or even none at all. This is quite a change from the 6-8 predicted just a few months ago.

This, we believe, is the reason for the decline in stocks this month.

____

CORPORATE EARNINGS

We’re about halfway through the corporate earnings reports for the first quarter.

The results haven’t been that bad – there have been some very positive reports, and some very negative. Most reports leaned to the positive side and we’re on track to see earnings growth of about 3.5% and revenue looks to be growing at about 4.0% according to Factset.

Overly positive or negative reports did see those stocks move on the results, but overall, we don’t think these reports had much responsibility for the direction of stocks this month. If anything, they muted some of the decline.

____

INFLATION

Inflation is a key economic metric the Fed follows, which is why we discuss it first. Inflation had been trending lower over the last two years, which was why investors believed the Fed will start lowering rates soon.

However, the inflation level seems to have stalled over the last several months and rate cuts are looking less likely.

While you can see a large decline in inflation in the chart above, that’s looking at it from an annual perspective. If you were to look at inflation month-by-month, prices continue to rise every month.

Excluding energy and food, which economists call the “core” measurement, inflation is still solidly rising every month.

The PPI, which is the inflation at the business level before they pass on the price increases to us, showed another increase last month.

____

OTHER ECONOMIC DATA

Economic data released this month was mixed. Overall, the economy still looks healthy, but there are pockets of concern.

We’ll start with the GDP report for the first quarter, which showed the economy still growing, though at a slower pace.

A lot was made of this report. Some analysts looked at it and said growth was slowing and it’s a bad sign. Others would say it’s a positive because we’re still expanding and have defied the critics who forecasted a recession.

Both are true. The economy is growing as people continue to spend. But we are concerned about this spending.

We all know the cost of everything has risen. In some cases, by a lot. We think much of this spending is people trying to keep up with the price increases as they buy the things they need. Many people cannot afford the price increases and credit card usage is rising, and credit card defaults are also rising.

Credit card defaults often rise before and during recessions, so this is a good indicator to keep an eye on for the health of the economy.

Both are true. The economy is growing as people continue to spend. But we are concerned about this spending.

We all know the cost of everything has risen. In some cases, by a lot. We think much of this spending is people trying to keep up with the price increases as they buy the things they need. Many people cannot afford the price increases and credit card usage is rising, and credit card defaults are also rising.

Credit card defaults often rise before and during recessions, so this is a good indicator to keep an eye on for the health of the economy.

Next, we’ll look at the leading economic indicators, which we’ve talked about for many months. This index combines many other indicators that tend to signal the direction of the economy (like weekly unemployment numbers, building permits, etc.).

This index had been lower for 22-straight months now, but it finally turned higher last month. Unfortunately, it turned lower again this month. This is another good recession indicator, so it is something to keep an eye on, too.

This index had been lower for 22-straight months now, but it finally turned higher last month. Unfortunately, it turned lower again this month. This is another good recession indicator, so it is something to keep an eye on, too.

Here are the various indicators used in the leading indicator index:

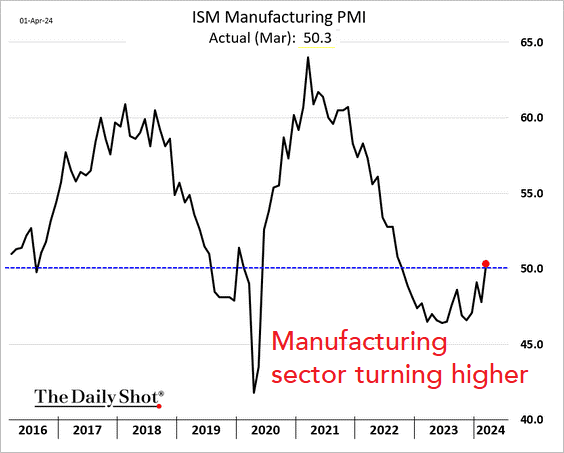

The manufacturing sector of our economy has turned the corner and is no longer contracting (a number below 50 indicates contraction). The services sector is expanding, but it took another turn lower last month.

Retail sales saw a nice improvement last month:

Durable goods (these are items with a longer life, like a phone or refrigerator) also moved higher.

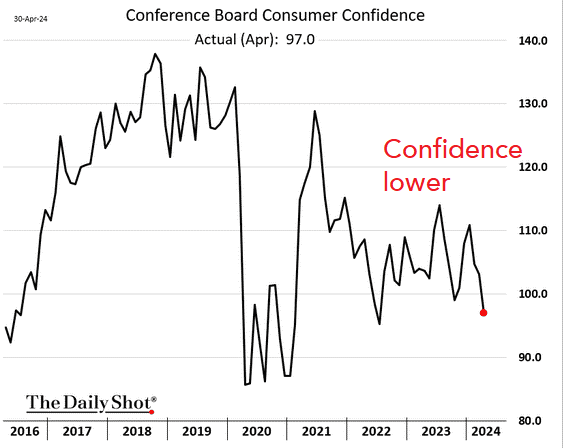

Consumer confidence dropped again last month:

Small business optimism was lower again, too:

____

Where does the market go from here?

The market hit oversold levels this month, which indicated a good time to buy (from a shorter-term perspective). The rally did appear, but it didn’t last long before another downturn at the end of the month.

News from later this week will give us a better idea on the direction of the market, with the Fed making comments later today, and employment reports at the end of the week. Inflation reports will also be important to keep an eye on. Positive economic reports and tougher talk from the Fed will keep sending the markets lower.

This commentary is for informational purposes and is not investment advice, an indicator of future performance, a solicitation, an offer to buy or sell, or a recommendation for any security. It should not be used as a primary basis for making investment decisions. Consider your own financial circumstances and goals carefully before investing. Past performance cannot guarantee results.