Hello all - we hope you had a nice May.

The markets started the month strongly, with bad economic news helping markets higher. Bad news is good news for stocks, since it means the Fed would be more likely to help markets with more stimulus from lower interest rates.

However, the Fed members were out in force this month saying they don’t see a rate cut any time soon. This put a damper on the excitement and stocks fell as a result.

The major markets saw a wide divergence in performance, with the Dow up 2.3%, the S&P 500 rose 4.8%, and the Nasdaq, which has a higher concentration of tech stocks, was higher by 6.9%.

The markets started the month strongly, with bad economic news helping markets higher. Bad news is good news for stocks, since it means the Fed would be more likely to help markets with more stimulus from lower interest rates.

However, the Fed members were out in force this month saying they don’t see a rate cut any time soon. This put a damper on the excitement and stocks fell as a result.

The major markets saw a wide divergence in performance, with the Dow up 2.3%, the S&P 500 rose 4.8%, and the Nasdaq, which has a higher concentration of tech stocks, was higher by 6.9%.

Here’s a look at how the markets moved this month:

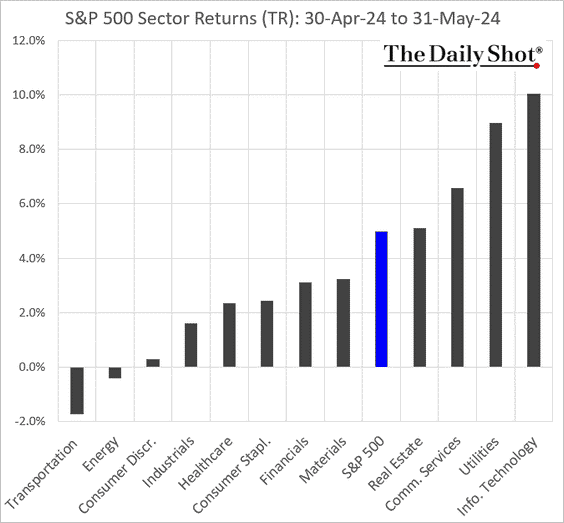

Here’s a look at how the various sectors performed this month:

The big names continue to get bigger and make up more of the S&P 500 index. The chart below shows how large the top-four names have become. It’s been decades since we’ve seen concentration like this, and it usually doesn’t end well.

Those big names are very popular because they have performed very well recently. Nvidia, for example, is up 25% this month. That’s incredible!

When those big names perform well, it makes the indexes look better than they probably are. When we look at the index with all 500 stocks balanced to be the same size (they call this “Equal Weighting”), we can see how poorly the market has performed recently.

When those big names perform well, it makes the indexes look better than they probably are. When we look at the index with all 500 stocks balanced to be the same size (they call this “Equal Weighting”), we can see how poorly the market has performed recently.

____

ECONOMY

You’ll notice that the big, top-performing stocks are tech stocks. The tech sector has done very well, but the market and economy are more than just tech stocks. We think the strength of tech may be masking underlying weaknesses in the broader economy.

To prove this, we look at the retail sector. The retail sector ETF (ticker RTH) holds stocks like Amazon, WalMart, CVS, etc. It gives insights into how the businesses who sell everyday items to customers are actually doing.

While the markets are higher on the month, the retail sector ETF is lower. Thihs is a red flag signaling weakness in the economy.

A chart makes this easier to see. Below is a look at the retail ETF (the black line), and we can see how much it has underperformed tech stocks (the gold line).

We think the rising prices that everyday Americans face is causing this stress. Costs keep rising and people can’t keep up with the price increases. A rise in credit card defaults is evidence of this.

We think this is a bad sign. Prices tend to rise strongly before recessions hit. While recessions are painful, they are necessary in correcting market imbalances and it’s the only way we’ll see prices come down. We worry we may be creeping towards that breaking point.

____

CORPORATE EARNINGS

Despite our concerns, corporate earnings continue to do well.

With earnings for the first quarter largely in for all companies in the S&P 500, earnings have risen about 6%. This is the best quarter in two years.

We think much of the increase in earnings is actually from inflation (or is causing inflation, depending on how you look at it). Companies are selling fewer products or services, but they have raised prices so high and that allows them to earn more. This trend doesn’t usually last long and ends badly.

____

INFLATION

Let’s look at the inflation data from this month.

The annual inflation level ticked slightly lower in the most recent report, but that rate hasn’t moved much in the past year (the gray line).

We think the monthly inflation chart is more important. While the press likes to talk about how the inflation rate has come down, the monthly chart shows that inflation continues to rise every month. One month builds on every month before it, which is why you’re seeing real concerns about high price levels and a struggling consumer.

Even worse, when excluding energy and food from the inflation calculation, (which economists call the “core” measurement) inflation is solidly rising every month.

The PPI, which is the inflation at the business level before they pass on the price increases to us, showed another increase last month.

____

OTHER ECONOMIC DATA

Economic data released this month was mostly lower.

We’ll start with the GDP report for the first quarter, which shows the strength of the economy. The number was originally released last month, but this month it was revised lower. The chart below shows how the data has been trending lower.

Next, we’ll look at the leading economic indicators, which we’ve talked about for many months. This index combines several indicators that tend to signal the direction of the economy (like weekly unemployment numbers, building permits, etc.).

This index had been lower for 22-straight months before finally turning higher two months ago. Unfortunately, the positive report is looking like a one-off, as the index continues to deteriorate. This report is a good recession indicator, so it is an important one to watch.

This index had been lower for 22-straight months before finally turning higher two months ago. Unfortunately, the positive report is looking like a one-off, as the index continues to deteriorate. This report is a good recession indicator, so it is an important one to watch.

Here are the various indicators used in the leading indicator index:

Last month the manufacturing sector of our economy turned the corner and was no longer contracting (a number below 50 indicates contraction). Unfortunately, it dipped into contraction again this month.

The services sector also dipped into contraction.

The services sector also dipped into contraction.

Retail sales declined:

Durable goods (these are items with a longer life, like a phone or refrigerator) was the one positive economic indicator we follow.

Consumer confidence moved slightly higher:

Small business optimism moved slightly higher, too:

____

Where does the market go from here?

The month closed out at an interesting point. Stocks are oversold on a short-term basis and look ready to rebound. We actually saw a lot of stocks moving higher, with good volume indicating solid buying interest.

The problem is what we discussed earlier in this commentary – a few large stocks are making up a larger part of the index. These tech stocks saw weakness at the end of the month and that’s kept the overall market from rising.

We need to see these tech names move higher if we want the indexes to move higher, too.

This commentary is for informational purposes and is not investment advice, an indicator of future performance, a solicitation, an offer to buy or sell, or a recommendation for any security. It should not be used as a primary basis for making investment decisions. Consider your own financial circumstances and goals carefully before investing. Past performance cannot guarantee results.